Get Gap Cover

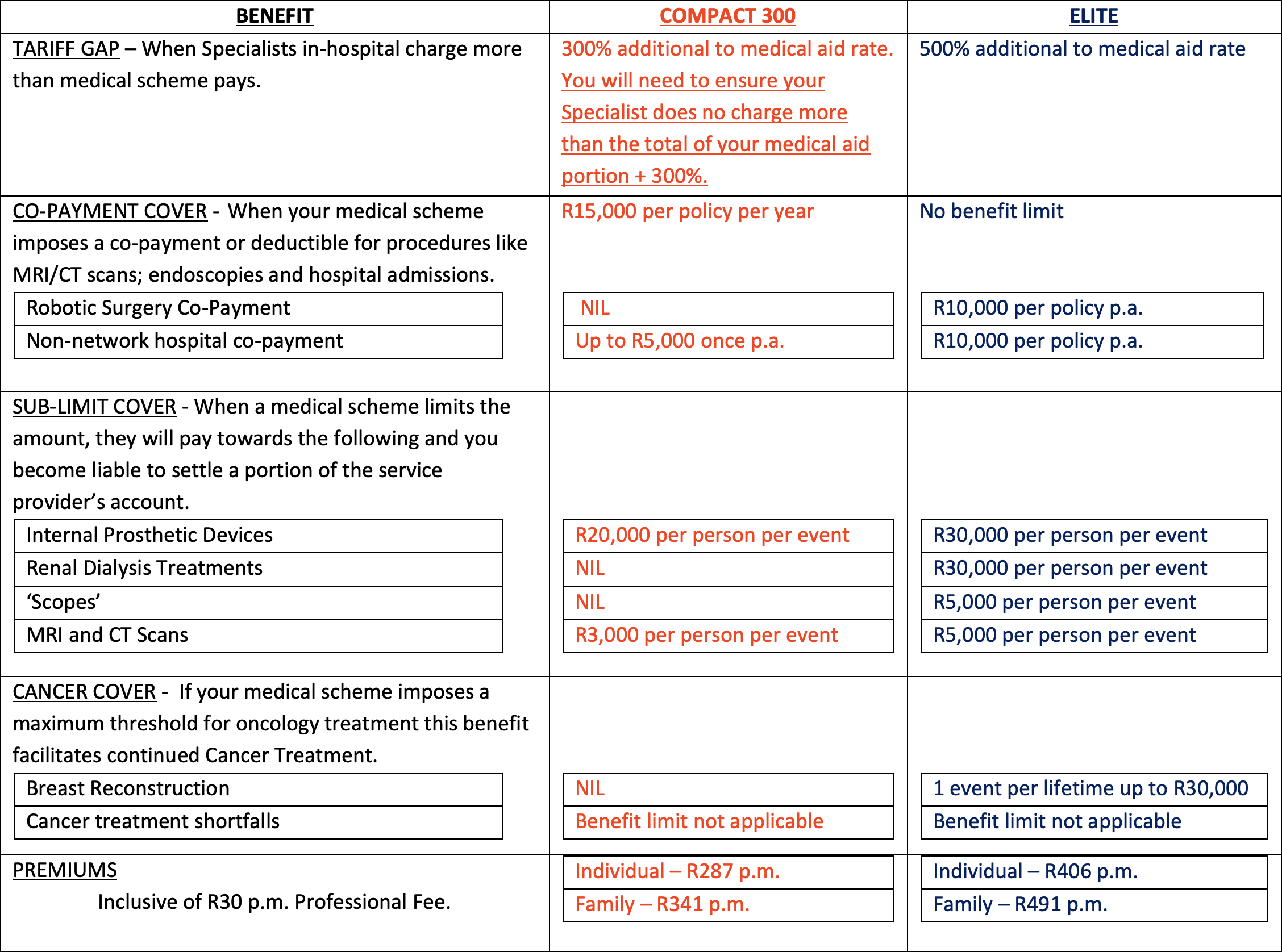

Up to 75% of all Medical Aids do not pay Specialists’ bills in full. In fact, most only pay a third of the Specialist’s bill for in-hospital procedures. In addition, Medical Aids are passing on more expenses to their members in the form of co-payments, deductibles and sub-limits. These additional and unexpected financial expenses (shortfalls) become a burden unless you have GAP Cover.

Cover and Cost Dependencies

a) The age of the oldest member or dependent at the time of submitting your application.

b) Whether you select a Family pricing or an Individual-Member pricing option.

c) The categories or shortfalls you wish to protect against.

Gap Benefit

Provides up to 500% additional cover where Specialists in-hospital charge more than your medical aid will pay.

Co-Payment Benefit

Reimburses you the out-of-pocket expense where your medical aid imposes co-payments and/or deductibles. For example: Hospital Admission, MRI’s, CT Scans and Endoscopies.

Sub Limits Benefit

Most medical aid schemes limit how much they will pay for certain procedures, operations and/or internal prosthetics. The sub-limits benefit helps cover the cost of these.

Cancer Benefit

Medical schemes limit their liability for cancer treatment by either imposing a co-payment when treatment exceeds a certain cost threshold or setting a limit on how much they will pay for oncology treatment in any calendar year. The Breast Reconstruction, Cancer Treatment Shortfalls and/or Cancer Treatment Top-up Benefits provide additional financial support in these instances.

General Information

We don’t cover healthcare or service providers’ accounts related to any medical procedure, treatment, hospitalisation, illness, disease, loss, damage, death, bodily injury or liability for:

1. events that occurred when you weren’t an insured person.

2. events that occur during a policy waiting period unless it’s for accidental events.

3. events where your policy’s overall policy limit or a benefit limit has been reached.

4. amounts that exceed the additional 300% or 500% cover that your policy provides.…

5. events where your policy doesn’t provide the right benefit to claim from.

6. events that could be covered under more than one benefit provided by your policy, but because your initial medical event’s been assessed and registered under a specific key benefit, continuation of treatment as a result of your initial medical event or events that follow your initial medical event, won’t be assessed under another benefit.

7. claims that we’ve assessed as Prescribed Minimum Benefit (PMB) medical procedures that your medical aid reviews afterwards, and partly or fully pays according to the agreed payment arrangement your medical aid has with your healthcare or service provider.

8. events where you didn’t obtain pre-authorisation from your medical aid, or where you didn’t follow your medical aid’s rules.

9. maxillofacial surgery and related medical conditions or procedures, unless it’s related to accidental injury or cancer.

10. prescription medication that you collect at a pharmacy or medication that’s given to you to take home, unless your policy has a benefit that covers it.

11. external prostheses, like artificial limbs.

12. external medical items, like crutches and birthing pools.

13. mechanical or computerised devices, like ventilators, unless your policy has a benefit that covers it.

14. co-payments related to robotic surgery, unless your policy has a benefit that covers it.

15. artificial insemination, infertility treatment, procedures or contraceptives, unless you’re claiming for tubal ligation, a vasectomy or a contraceptive device implant if your policy has a benefit that covers it.

16. obesity and bariatric surgery.

17. reconstructive cosmetic surgery.

18. a breast reconstruction if it’s not the first breast reconstruction in your lifetime. (A breast reconstruction can be an implant or removal of a breast implant.)

19. home nursing, admission to a step-down or sub-acute facility, like a frail care centre, rehabilitation facility and hospice, unless your policy has a benefit that covers it.

20. mood disorders, emotional or mental illnesses, unless you’re claiming for counselling under our Trauma Counselling Cover benefit.

21. sleeping disorders.

22. stem cell harvesting or treatment.

23. costs related to medical reports.

24. claims where we’ve negotiated discounts with your healthcare or service providers and paid them in full.

25. claims that are resubmitted due to your healthcare or service provider increasing their fees resulting in additional shortfalls, but your claim’s already been finalised by us.

26. information that you didn’t tell us about that can affect the assessment or acceptance of risk.

27. events that are covered by more than one Gap Cover insurer.

28. routine physical, diagnostic procedures or examinations that you go for as a standard and not because you require medical attention, unless your policy has a benefit that covers it.

29. transport charges and healthcare services that’s provided to you while being transported in an emergency vehicle, vessel or aircraft.

30. deliberate criminal or fraudulent acts, or any illegal activity conducted by you or a member of your household which directly or indirectly results in loss, damage or injury.

31. attempted suicide or intentional self-injury.

32. deliberate exposure to exceptional danger unless you attempt to save a human life.

33. events where the use of drugs or alcohol is involved.

34. riots, wars, political acts, public disorder, terrorism, civil commotions, labour disturbances, strikes, lock-out or any attempt to such acts.

35. active military, police or police reservist activities while you are on active duty.

36. nuclear weapons material, ionising radiations or contamination by radioactivity from any nuclear fuel, nuclear waste or from the combustion of nuclear fuel that includes any self-sustaining process of nuclear fission.

37. events that are covered by legislation, like contractual liability and consequential loss.

YOUR WAITING PERIODS

From the first day that your cover starts with us, waiting periods will apply before you can claim any of your policy benefits.

– THREE MONTH GENERAL WAITING PERIOD

– 12 MONTH PRE-EXISTING CONDITION SPECIFIC WAITING PERIOD

– PRE-DIAGNOSED CANCER WAITING PERIOD

…

YOUR WAITING PERIODS

THREE MONTH GENERAL WAITING PERIOD

Within the first 3 months of cover, a general waiting period will apply, where no claims can be submitted unless you are claiming for an injury resulting from an accident caused by physical impact.

12 MONTH PRE-EXISTING CONDITION SPECIFIC WAITING PERIOD

Within the first 12 months of cover, a waiting period for pre-existing medical conditions will apply, where no claims can be submitted for a procedure, surgery, treatment or an investigation relating to any illness or condition for which you received advice or treatment 12 months before your cover start date.

PRE-DIAGNOSED CANCER WAITING PERIOD

Where cancer is diagnosed before the first day your cover starts, all cancer and related claims can only be submitted after you have been in remission for a minimum period of 3 consecutive years from the date you are confirmed to be in remission.

We do not cover service providers’ accounts for related medical procedures and/or treatment, hospitalisation, illness, disease, loss, damage, death, bodily injury or liability that is caused by or results from:

1. An event where the claimant is not an insured person at the time of the event unless a benefit specifically makes provision for cover.

2. Medical scheme exclusions where no underlying cover exists, unless a benefit specifically makes provision for cover.

3. An event where a benefit limit or an Overall Policy Limit (OPL) has been reached.

4. An event where the policy does not provide the relevant benefit to claim from.

5. An event where pre-authorisation was not obtained from the medical scheme or where medical scheme rules were not followed.

6. An event where the use of a hospital, day-clinic or service provider was voluntary and the service provider does not form part of the medical scheme’s network unless a benefit specifically makes provision for cover.

7. An event that occurs during a policy waiting period, unless otherwise specified.

8. Maxillo-facial surgery and related medical conditions and / or and/orprocedures unless due to accidental impact resulting in severe physical injury.

9. Dental implants, orthodontic, prosthodontic or cosmetic dentistry.

10. External prostheses or appliances such as artificial limbs, wheelchairs and crutches.

11. Robotic surgery, specialised mechanical or computerised appliances and equipment.

12. Artificial insemination, infertility treatment or contraceptives except for tubal ligation and vasectomies.

13. Obesity.

14. non-medically necessary reconstructive cosmetic surgery.

15. Breast reconstruction performed as a second or subsequent reconstruction.

16. Home nursing or admission to a step-down facility such as a frail care centre, unless a benefit specifically makes provision for cover.

17. Depression, insanity, emotional or mental illness or any stress-related conditions.

18. Costs associated with supporting medical reports that assist in the finalisation of a claim.

19. Routine physical, diagnostic procedures or examination where there are no objective indications or impairment in normal health.

20. Expenses incurred for transport charges or services rendered whilst being transported in an emergency vehicle, vessel or aircraft.

21. Riots, wars, political acts, public disorder, terrorism, civil commotions, labour disturbances, strikes, lock-out, or any attempted such acts.

22. A deliberate criminal or fraudulent act or any illegal activity conducted by you or a member of your household which directly or indirectly results in loss, damage or injury.

23. Attempted suicide, intentional self-injury and deliberate exposure to exceptional danger except in an attempt to save a human life.

24. An event where the use of drugs or alcohol is involved.

25. Active military, police and police reservist activities whilst on active duty.

26. Nuclear weapons material, ionising radiations or contamination by radioactivity from any nuclear fuel, nuclear waste or from the combustion of nuclear fuel that includes any self-sustaining process of nuclear fission.

27. Events that occur for which the actual damage is provided for by legislation, including contractual liability and consequential loss.

28. Discounts negotiated by an insured person directly with a service provider where reimbursement of a claim will enrich the insured person.

29. Non-disclosure of material information that is likely to affect the assessment or acceptance of risk.

I have carefully considered the Gap Cover options made available to me and have selected the option that meets my medical aid shortfall requirements both in terms of benefits and affordability of the monthly premium and, as such, have waived my right to a complete Gap Cover needs analysis.

I have read and understood the most significant waiting periods and exclusions applicable to my Gap Cover policy as described below.…

3-MONTH GENERAL WAITING PERIOD – Within the first 3 months of cover a general waiting period will apply, where no claims can be submitted unless you are claiming for an injury resulting from an accident caused by physical impact.

12- MONTH PRE-EXISTING CONDITION WAITING PERIOD – Within the first 12 months of cover a waiting period for pre-existing medical conditions will apply, where no claims can be submitted for a procedure, surgery, treatment or an investigation relating to any illness or condition for which you received advice or treatment 12 months prior to your cover start date.

Where a claim under our GAP BENEFIT, CO-PAYMENT BENEFIT or SUB-LIMIT BENEFIT is received for a condition, procedure, surgery, treatment or an investigation and any related accounts in respect of Adenoidectomy, Tonsillectomy, Myringotomy/Grommets, Cardiovascular procedures, Cataract removal, Dentistry, Hysterectomy (unless due to cancer diagnosis), Hernia repair, Joint replacement, MRI, CT and PET scans, Nasal and sinus surgery, Pregnancy and childbirth, Spinal procedures and Scopes within the first 10 MONTHS of cover, where this is not deemed a pre-existing or accidental, 20% of the total claim amount will be payable, where applicable.

I agree to familiarise myself with all documents to follow via e-mail after acceptance and activation of my gap cover policy. These documents will contain full information about the benefits, limitations and more detailed descriptions of waiting periods and exclusions which, upon acceptance of cover, constitutes my binding acceptance of the terms and conditions of my Gap Cover Policy.

I acknowledge and agree that my policy will only come into force upon receipt of the first premium and my benefits will only remain in force with the continued premium payment due to the insurer. It is my sole responsibility to ensure premiums and any other charges due are paid in full for my policy benefits to remain active. If my premium payment is unsuccessful, I will not have any cover for the period for which I do not pay. If I have a returned debit order, I agree that the insurer will process a debit order for the month for which payment is outstanding as well as the next month’s premium plus a non-refundable administration fee of R25, on my chosen debit order date. If payment of my two months’ premium is not received my policy will be cancelled immediately effective the last day of the month for which payment was last received.

If I have elected individual member pricing, it remains my responsibility to notify the insurer/broker of any changes to my medical aid dependents so that all family members are covered under my policy. Failure to do so will result in Gap Cover claims for such dependents being rejected and the resultant medical aid shortfall(s) being for my own account

GetGapCover acts as a marketing entity for the registered Financial Service Provider as noted on the attached application form. The staff and management of GetGapCover are not authorised to offer either financial advice or perform intermediary services. They may, however, provide Gap Cover product specific information.

In terms of the Short-term Insurance Act, the Registered Financial Services Provider will be paid commission capped at the regulated percentage and this commission is included in the premium disclosed on the application form. Your policy will be reviewed on an annual basis by the insurer.

Frequently Asked Questions

Is Gap Cover a Medical Aid?

No. Gap Cover products are defined either, under the definition of “accident and health policy”, in the Short Term Insurance Act No.53 of 1998, or the Long-term Insurance Act, 1998.

Does it cover day to day procedures?

No. Gap Cover covers mainly in-hospital shortfalls and co-payments, together with certain listed procedures that might be performed on an out-patient basis.

How long does it take to assess a claim?

Claims are assessed and paid, providing all the relevant documentation is received upfront, within 14 days.

Does this cover my whole family?

IF YOU SELECT A FAMILY A FAMILY PRCING OPTION THEN, YES, Your Get Gap Cover policy covers the main member and all dependents listed on the medical aid scheme. It is best to provide a copy of your Medical Aid Membership Certificate with your Get Gap Cover application. IF YOU SELECT AN INDIVIDUAL MEMBER PRICING OPTION THEN ONLY THAT MEMBER WILL BE COVERED.

Does it matter how large my family is?

Certain products limit the size of the family or require certain criteria e.g. all insured members must belong to a Medical Aid. It is your responsibility to notify us of any changes to your medical aid membership due to marriage, and/or births to ensure sufficient coverage for all dependants. Failure to do so will result in out of pocket expenses for you.

Is it only hospital procedures that are covered?

Out–of–hospital benefits are not covered; however certain listed procedures are covered on an out-patient basis. Refer to the policy document for more comprehensive details.

Who gets paid when my claim is settled – the doctors or me?

We reserve the right to negotiate a reduced tariff from the Specialist concerned for direct settlement of the shortfall. Direct settlement or settlement to the policyholder will be communicated to our policyholder via a Claims Payment Summary notice.

What happens if I am sick, pregnant or about to have an operation when I take out this policy?

A 12 month pre-existing medical exclusion is a standard exception on all Gap Cover products. Therefore any ailment that was treated 12 months prior to the inception of the policy will not be cover for a period of 12 months. Special terms exist for groups; please contact us for details.

What is the maximum entry age and how long do I stay on thereafter?

How do I cancel membership?

One calendar months notice period in writing is required.

Does this plan cover dental procedures?

Certain dental procedures performed in hospital are covered under the Dentistry benefit.

Do you need original accounts?

No, scan copies are accepted by the underwriting department.

Are the premiums Tax deductible?

No, the policies fall under the definition of “accident and health policy”, in the Short Term Insurance Act No.53 of 1998, or the Long-term Insurance Act, 1998 and not the Medical Schemes Act, 1998.